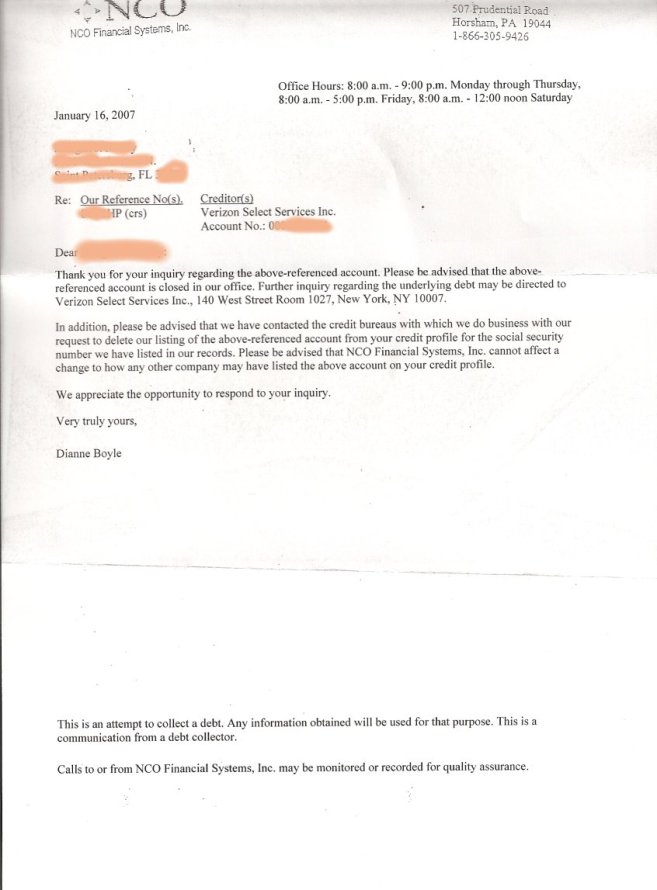

NCO Debt Collection agency responds

Posted by noholdsbarred on January 20, 2007

Posted in Credit Bureaus, NCO, Verizon | 47 Comments »

NCO Debt validation – the story continues

Posted by noholdsbarred on January 10, 2007

NCO still hasn’t responded to my debt validation. It has been almost 30 days. All three credit bureaus acted with in days and removed the item. By law, is NCO required to respond to my DV request, or does just erasing the account satisfy their legal requirements?

I’ll wait a few more days and write another letter. I’d lke to get the addresses of some of the higher ups at NCO. I’m not satisfied with the accounts just being removed, I want to be sure that this debt will never come back to haunt me again. I want NCO to admit, in writing, that this was an error and not a valid debt. Do I have a chance of getting that? Thoughts?

I’m still contemplating what legal recourse I might have for the time period that my credit was damged. If I can indeed that the reporting error caused me some damages.

Posted in Credit Bureaus, NCO | 13 Comments »

3 for 3

Posted by noholdsbarred on December 27, 2006

I got my dispute results back from TransUnion today, and just like Experian and Equifax, they also removed the NCO collection account. TransUnion was the only bureau I communicated with via postal mail, and I was again surprised at how quickly they carried out their investigation.

So one goal is accomplished and many of you would say “it’s over, let it go”. I can’t do that. I’ve read to many accounts of collection accounts being sold and resold (probably traded between the agencies), and reappearing on credit reports months or years after the consumer successfully disputed them. I don’t want that to happen.

I also want to find out who is at fault for this error. NCO or Verizon? Still waiting on NCO’s response to my debt validation letter.

Posted in Credit Bureaus, Equifax, Experian, NCO, Transunion | Leave a Comment »

Happy Holidays

Posted by noholdsbarred on December 24, 2006

Have a good safe one everyone. We’ll get those ratbastards eventually

Posted in General, Uncategorized | Leave a Comment »

Boycott?

Posted by noholdsbarred on December 23, 2006

I just posted this to Fatwallet.com, which by the way is a kick ass site.

Since NCO could give a crap about how bad random consumers trash them, I wonder: What if I collected the names of all the companies who contract or sell debts to that crooked NCO outfit and I posted their contact info? What if people wrote letters to those companies, saying they were boycotting their good or services until such time that they cease doing business with NCO? Would it have any effect on NCO? Would enough people participate in this effort? Do I ask to many stupid questions?

|

|

Posted in Credit Bureaus, NCO, Uncategorized | 3 Comments »

More NCO crap

Posted by noholdsbarred on December 23, 2006

Check out this news story on NCO –

http://cbs4boston.com/specialreports/local_story_143211824.html

Also take a look at this video expose from CBS4 Boston:

Posted in Credit Bureaus, NCO | 1 Comment »

Sue Happy

Posted by noholdsbarred on December 23, 2006

I’m not “sue happy”, but I want whomever screwed up my credit score, albeit temporary, to pay. The bureaus will fix it, but whomever reported it wrong needs to be held accountable. If it was a simple case of identity theft, that could have been solved years ago by someone sending me a bill in the mail. I would have taken one look at the bill, called to dispute it, and voila – problem solved. Instead this account is supposedly 6 years old and in collection. In all that time Verizon never reported this account to a credit bureau. Why not? All this is what make me think this is more a clerical screw up, not a case of indentity theft.

As pointed out in the FatWallet thread it was most likely a clerical mistake. I could accept that. Really, I could. What made this whole thing so unacceptable, in my eyes, was the conduct of NCO staff when I called to find out what the fuck this was all about. I was treated like pond scum. Guilty until proven innocent. And there was no nope of being proven innocent. While every company has assholes working for them, apparently being one is a pre-requisite for employment at NCO. There’s plenty of testimonials out there to support that statement, and I’ll post them soon. Folks, I know collection agencies are not in the business of servicing the consumer, but there are those that act ethically and professionally.

Now I didn’t expect to clear anything up by calling them, I merely wanted to find out who was reporting this debt and how I could contact them. They could have treated me like a human being and been done with me. They chose not to, so here I am.

Another good point from the FatWallet thread is that NCO could care less what us consumers say about them. They are debt collectors and as such, they are not in the business of making consumers happy. They don’t need our approval. So me ranting here about how terrible they are will do nothing to hurt them. Like I said, that is a good valid point, but I have an idea that might rock their world a little bit. No, it’s not a lawsuit, or complaints to the FTC, AG, BBB or anyone else (although complaints should be filed against them), my idea might actually cause them some concern. I know I would need your help. Let me sleep on it and we’ll discuss it more tomorrow.

Posted in NCO | Leave a Comment »

NCO no stranger to the FTC

Posted by noholdsbarred on December 23, 2006

Cut and paste from: http://www.ftc.gov/opa/2004/05/ncogroup.htm

NCO Group to Pay Largest FCRA Civil Penalty to Date

One of the nation’s largest debt-collection firms will pay $1.5 million to settle Federal Trade Commission charges that it violated the Fair Credit Reporting Act (FCRA) by reporting inaccurate information about consumer accounts to credit bureaus. The civil penalty against Pennsylvania-based NCO Group, Inc. is the largest civil penalty ever obtained in a FCRA case.

According to the FTC’s complaint, defendants NCO Group, Inc.; NCO Financial Systems, Inc.; and NCO Portfolio Management, Inc. violated Section 623(a)(5) of the FCRA, which specifies that any entity that reports information to credit bureaus about a delinquent consumer account that has been placed for collection or written off must report the actual month and year the account first became delinquent. In turn, this date is used by the credit bureaus to measure the maximum seven-year reporting period the FCRA mandates. The provision helps ensure that outdated debts – debts that are beyond this seven-year reporting period – do not appear on a consumer’s credit report. Violations of this provision of the FCRA are subject to civil penalties of $2,500 per violation.

The FTC charges that NCO reported accounts using later-than-actual delinquency dates. Reporting later-than-actual dates may cause negative information to remain in a consumer’s credit file beyond the seven-year reporting period permitted by the FCRA for most information. When this occurs, consumers’ credit scores may be lowered, possibly resulting in their rejection for credit or their having to pay a higher interest rate.

The proposed consent decree orders the defendants to pay civil penalties of $1.5 million and permanently bars them from reporting later-than-actual delinquency dates to credit bureaus in the future. Additionally, NCO is required to implement a program to monitor all complaints received to ensure that reporting errors are corrected quickly. The consent agreement also contains standard recordkeeping and other requirements to assist the FTC in monitoring the defendants’ compliance.

The Commission vote to authorize staff to refer the complaint and consent decree to the Department of Justice was 5-0. The Department of Justice filed this matter at the FTC’s request in the U.S. District Court for the Eastern District of Pennsylvania on May 12, 2004.

NOTE: The Commission files a complaint when it has “reason to believe” that the law has been or is being violated, and it appears to the Commission that a proceeding is in the public interest. The complaint is not a finding or ruling that the defendant has actually violated the law.

NOTE: This stipulated final order is for settlement purposes only and does not constitute an admission by the defendant of a law violation. A stipulated final order requires approval by the court and has the force of law when signed by the judge.

Copies of the complaint and consent decree are available from the FTC’s Web site at http://www.ftc.gov and also from the FTC’s Consumer Response Center, Room 130, 600 Pennsylvania Avenue, N.W., Washington, D.C. 20580. The FTC works for the consumer to prevent fraudulent, deceptive, and unfair business practices in the marketplace and to provide information to help consumers spot, stop, and avoid them. To file a complaint, or to get free information on any of 150 consumer topics, call toll-free, 1-877-FTC-HELP (1 877-382-4357), or use the complaint form at http://www.ftc.gov. The FTC enters Internet, telemarketing, identity theft, and other fraud-related complaints into Consumer Sentinel, a secure, online database available to hundreds of civil and criminal law enforcement agencies in the U.S. and abroad.

MEDIA CONTACT:

Jen Schwartzman

Office of Public Affairs

202-326-2674

STAFF CONTACT:

William Haynes

Division of Financial Practices

202-326-3224

(FTC File No. 992-3012)

(Civil Action No. 04-2041)

Posted in NCO | 1 Comment »

Dispute Progress

Posted by noholdsbarred on December 22, 2006

I disputed the NCO entry with all three credit bureaus. I was able to do this online with Experian and Equifax. I had to use postal mail to Dispute with TransUnion.

I was extremely surprised at Experian. 48 hours after I filed the dispute, they alerted me through email that the entry had been deleted. Actually, it was less then 48 hours. Is that normal?

Equifax took a bit longer and responded via postal mail. but they also removed the entry. I had no idea the Credit Bureaus handled disputes so quickly.

I’m pretty confident that the TransUnion dispute will yield the same results.

I still want to know how this happened. I need answers from Verizon on how an account I never had could be sent to a collection agency, with absolutely no contact with me. Why didn’t a delinquent Verizon account ever appear on my credit report?

Why did NCO post to the bureaus, yet make no effot to contact me?

I emailed Verizon and got a form letter back in return. As soon as I can set aside some time (Probably Friday) I’ll be calling them for some answers. I’ll post the results here.

Posted in Credit Bureaus, NCO, Verizon | 3 Comments »

NCO and Verizon Story

Posted by noholdsbarred on December 21, 2006

On December 11 something triggered me into checking my credit report. The “something” that triggered me is fairly significant to me, but I don’t want to go into now. We’ll just say I got some news that prompted me to pull my report. Anyways, I went to freecreditreport.com and pulled a free report.

First, about me: I’m a 39 year old professional, with a stable career, home owner, above average income, recently married, and fairly clean credit report. At least I thought it was. I am able to track my TransUnion FICO score monthly, for free, through a credit card I have. Like many, I struggled with stupid credit issues during my twenty’s and even early thirties. Nothing major, just delinquent payments on credit cards and car payments. Some of those dings still appear on my reports, but several years of on time payments and paying my debt down, have allowed to me to watch my FICO score slowly creep up. Recently it has hovered a bit over 700. Not great yet, I know, but acceptable and slightly above the national average. It sure beats the low 600’s, which is where I was for awhile. Most of the negative entries on my report are due to come off within the next 12 – 24 months. It’s a great source of pride for me to straighten this part of my life out and to watch my credit rating continue to improve.

Back to the story. I pulled my free credit report and found a collection account from NCO listed. It posted last month (November 06) and is listed as an old “Verizon Services” account, opened in 2001. Balance due is $350. Thing is, I’ve never done business with Verizon. Alltel has been the only cellular provider I have ever used and I haven’t had a home landline for years, and when I did, it was through GTE and paid in full.

I called NCO and spoke to a very rude bitch. Of course she was unable or unwilling to give me much information and stated simply that this was my account and it needed to be paid today. Yeah right. I don’t handle business on any level based on emotion, so I wasn’t rude or nasty. I didn’t tell her what a nasty bitch I thought she was. I was able to get her to confirm my home address, twice, and they had it correct as reported to them by “Verizon Services”. She also confirmed that it was a cellular phone account. When it became clear to her that I wasn’t going to accept responsibility for this debt, be bullied, and was semi-intelligent, she told me I would have to send them a Debt Validation letter, and gave me their mailing address. She read the address incredibly fast, then hung up. Luckily I’m a fast writer.

Now being a collection agency, I realize NCO is not going to try to be of any assistance or help to get to the bottom of this. They may try to make us believe otherwise, to get into our pockets, but make no mistake about it, their sole purpose it to collect money from debts they have bought. They are not a customer service based business and they don’t care whether it is a legitimate debt they are trying to collect on or not. If they can get us to pay it, they will. Therefore, I did not waist time trying to reason with them further, or questioning them about the debt.

After all this happened, I did a little research on NCO. I found that as far as collection agencies go, they are the worst of the worst. Hey, lets face it, no one likes collection people, but there are those that act ethically, morally, and most importantly, legally. NCO seems to do none of the above. I’ll quantify that statement later.

Although the tone of this first post may not indicate it, I am indeed pissed about this. Very pissed. I’m pissed that NCO put this negative mark on all three credit reports, but never made an attempt to contact me about it, even though they had my correct mailing address. Had I not checked my credit report, I would have never found this entry.

I’m equally or more pissed at Verizon, who is supposed to be a reputable company, for selling this “false debt” to NCO, and also for not contacting me and advising me that there was a problem. Remember, I’ve had the same mailing address for over 11 years and never heard about this debt before!

These companies have to realize that when they report a negative item to a credit bureau, they are quite possibly jeopardizing someone’s livelihood. Shouldn’t they be 100% sure that what they are posting is accurate? Shouldn’t they make all reasonable efforts to notify an individual before posting a negative entry? If they don’t and they make a mistake that has a negative impact on someone, shouldn’t they be fined or suffer some punitive damages? What about my time that I am going to have to spend on fixing this? What is that worth?

It’s a cliché saying, but in this case it is fitting: They have fucked with the wrong person! Seriously, they have. I was pissed when I discovered the error, but the treatment I received when I called NCO was what pushed me over the edge and inspired me to really stick it to them. Hence, this blog. The problem with screwing people over in this day and age is that the average guy (and gal) can have a BIG voice, thanks to the internet.

So here’s the deal. I have no doubt that I will clear all three reports of this negative mark. It truly is an erroneous entry. My concern is that it will continue to reappear down the road as the collection agencies sell or trade the accounts they have been unable to collect on. I’m going to continue to pursue this with these companies and I will chronicle my efforts here. I hope my experiences will help aid others in dealing with these situations, if only by providing motivation to fight back. Stay tuned.

Posted in NCO, Verizon | 24 Comments »